Why Reviving Unconverted Insurance Quotes is Important:

Unconverted insurance quotes are a major pain point for all insurance companies. According to LSA, $867 is the average amount consumers spend on insurance upon reaching a decision and committing to a provider. Each undecided consumer is a major revenue opportunity for an insurance company.

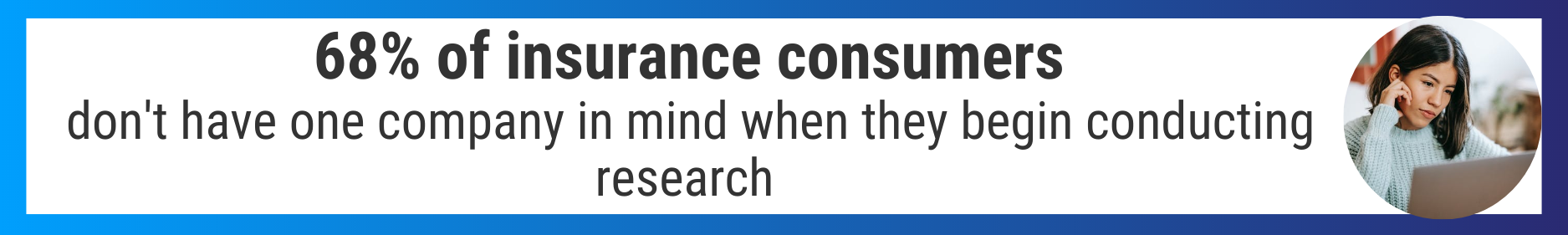

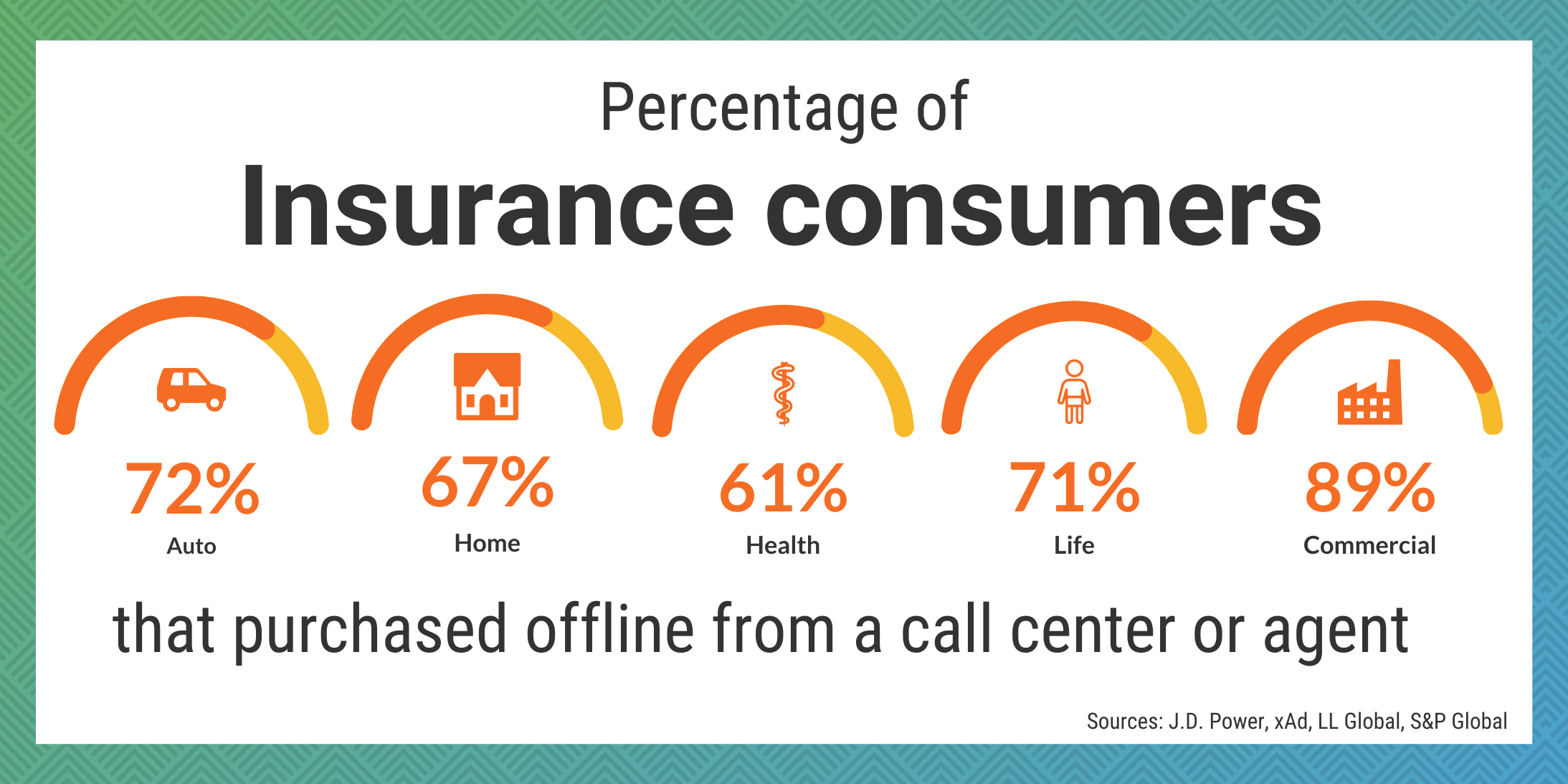

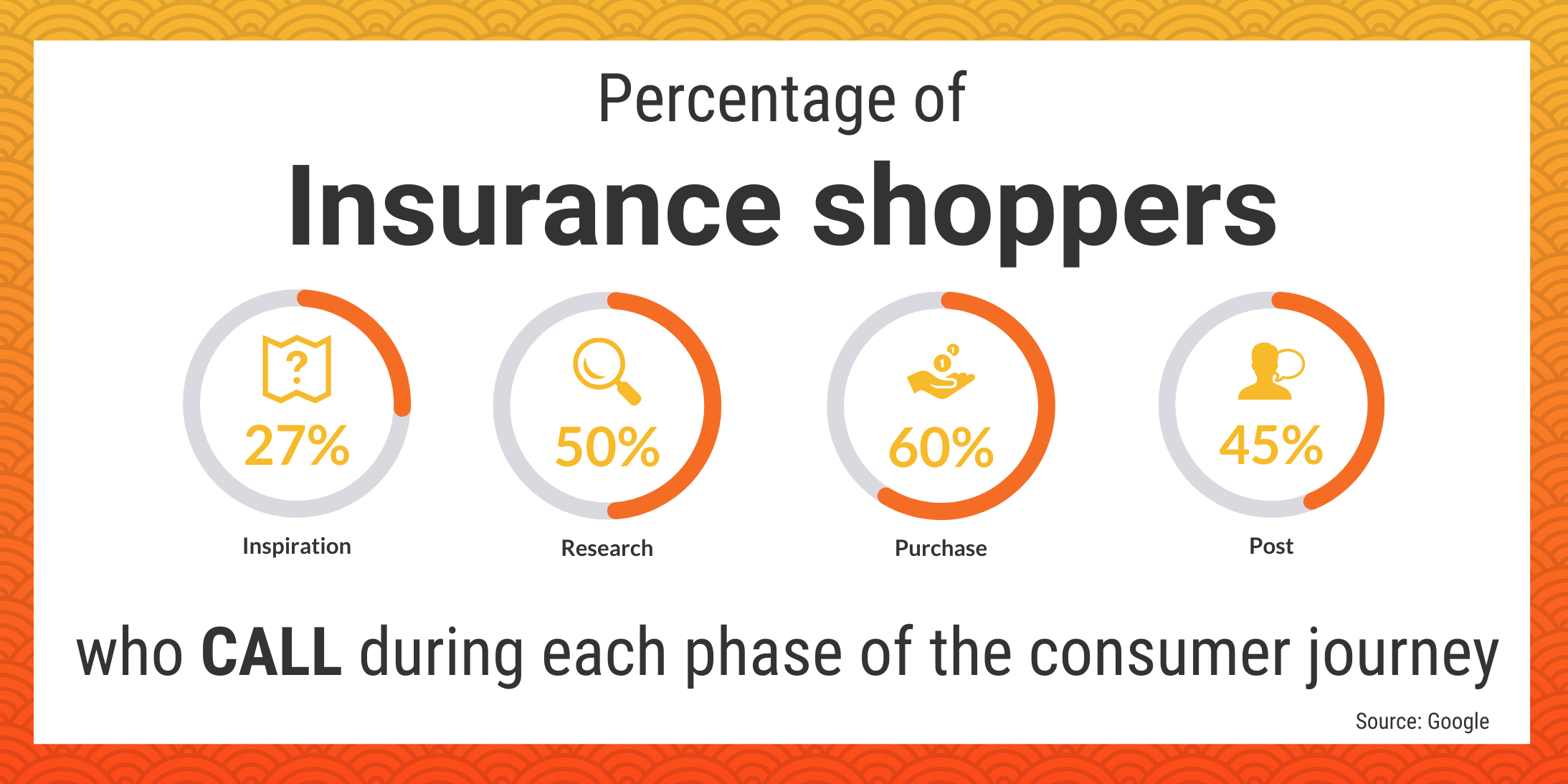

It’s important to note that when customers are searching for the insurance provider that best fits their needs, it is common for them to use a price comparison site. In fact 74% of potential consumers research their purchase online, but only 25% decide to complete their purchase online as most prefer to speak to a life agent to work out the finer details and make a purchase. This creates a highly competitive environment among brokers because these sites often compare over 100 different insurers.

Since insurance purchases are highly personal and have many considerations it’s important that companies take appropriate actions to standout and maximize on the needs of clients. For customers it’s not simply about the lowest price. Consumers want to know they are covered and understand fully what is included. This is why it is imperative that insurance companies engage with people quickly, effectively and have a plan in place to revive unconverted insurance quotes.

5 steps to help revive unconverted insurance quotes?

- Accurate data capture

-

- It’s difficult to speak to a customer if you don’t know who they are. This is why accurate data capture is important. Gathering important details such as name and phone number are an essential part of converting potential customers when they leave a quote incomplete and reviving any unconverted insurance quotes.

-

- Journey engineering starts with intelligence on clients and prospects. A journey map is a major step in collecting and acting on information based on clients and prospects navigation information. Act on these data points with engagement triggers designed to lead a client’s journey to the desired outcome, such as execute on an abandoned quote.

-

- Prioritizing valuable leads

-

Industry figures revels that if a potential lead receives a phone call within 15 minutes of researching a service online, they’re 3x more likely to take out a policy than if they receive the call just an hour later. This is one reason that once leads are being generated through the implemented data capture system it’s necessary to prioritize incoming leads. Through the use of priority filters companies can insure that leads with the lowest risk are sent straight through to agents, in order to maximize the chance of converting these leads.

Industry figures revels that if a potential lead receives a phone call within 15 minutes of researching a service online, they’re 3x more likely to take out a policy than if they receive the call just an hour later. This is one reason that once leads are being generated through the implemented data capture system it’s necessary to prioritize incoming leads. Through the use of priority filters companies can insure that leads with the lowest risk are sent straight through to agents, in order to maximize the chance of converting these leads.

-

- The flexibility of these filters is impressive and can be implemented on a variety of individual fields. When this is setup correctly, higher valuable clients can be given priority. However, it is important to continue to constantly adapt this process as it is discovered which priority filters generate the best leads resulting in the most revenue.

-

- Calling valuable leads

-

- Now call important leads. Many industries rely heavily on email remarketing. But this takes time and when it comes to the insurance industry time matters. Implementing an intelligent dialer puts an insurance company directly in contact with Internet leads through a traceable system.

-

- Implementing an effective reachout campaign

-

- Not all leads are contactable by pone. That’s why it is important to have effective reachout campaigns to contact current and potential clients. Interactive email, sms and/or social media campaigns ensure that potential consumers have a quote fresh in their mind. Adding videos and/or links to campaigns are more engaging than standard campaigns simply upselling a product or service.

-

- A continued marketing and engagement strategy

-

- Now that abandoned/ unconverted insurance quotes are being revived and new customers are being retained, maintaining customer information is more essential than ever. Effective marketing systems can help streamline and automate renewals, remarketing, promotions and gather essential feedback. These processes are essential aspects of providing quality customer service and their automation helps make providing exceptional customer service a lot easier.

-

- Implementing a system that can automate all of these processes makes life a lot easier. It also reduces errors that are common with less automated systems.

-

How can Interact Strategies Help?

Interact Strategies interactive omnichannel contact center technology can help CX centers cultivate better client relationships by helping insurance providers be more reachable, flexible and scalable. Thus, improving communications with clients, empower staff and making sense of the data that gets collected along the way.

We would like your feedback to help improve your work day. Help us streamline processes by providing insight into center operations at your CX center.

|

View survey here |